OPERATIONAL EXCELLENCE AT TESCO: ANALYSING IMPACT AND STRATEGIC RECOMMENDATIONS

Introduction

Operations management is the process of administering the business activity, and practices, maintaining various processes and structures to optimise efficacy and increase profit. It is the management of the regular activity of a business enterprise which assists in overseeing the activity of multiple departments and establishing goals. Tesco is one of the largest multinational retailers in the UK, headquartered in “Welwyn Garden City”, England. The enterprise sells general merchandise and groceries in the global market and is one of the most “valuable brands” in the UK. The study discusses the operations management of Tesco to analyse its impact on organisational success and relevant recommendations.

Elaboration of various processes at Tesco

Tesco has widely diversified its products by providing consumers with books, toys, electronics, and clothing along with various other services. The firm also has telecom, financial and subsidiaries for internet services. Tesco has repositioned itself as a “low-cost” retailer which has assisted the enterprise in gaining popularity among consumers (Tesco, 2023). The enterprise offers “Tesco Value” products and “Tesco Finest range” which aids the firm in capturing diverse consumer segments. Tesco has also established its online retail website through which it has been able to meet the online shopping requirements of consumers in the UK. The enterprise currently employs nearly 345,000 workers to serve consumers properly and is dedicated to delivering sustainable food (Dhyana and Gupta, 2022). Tesco has also introduced its fast delivery service “Whoosh” which is available for consumers from nearly 1,000 “Express stores”.

It enables consumers to buy products from a curated list which contains around 2,500 to 4,500 essential goods which can be delivered in 30 minutes. It also charges a nominal cost of “£2.99” in delivery fee for orders which cost over £15. Tesco has also launched its brand of fresh foods, such as “Boswell Farms” and “Redmere Farms”. It has helped the firm offer fresh and quality goods to consumers at affordable prices (Rosnizam et al. 2020). Furthermore, the firm has integrated a “value chain transformation strategy” to improve its consumer service and enhance its operational efficacy. The inbound logistic service is supported by data analytics to assess product sales, inventory management and demand forecast. It has assisted the company in managing its diverse supplier network and distributors to provide adequate goods for consumers.

Tesco has over 4600 stores worldwide in diverse formats such as Extra, Metro and Express. Few stores the firm generally stays open 24 hours every day which creates significant value for the consumers by providing easy access to essential goods at any time. Along with its delivery system, it also has a “Click + Collect system” through which the consumers can collect their orders from a specific “collection point” in exchange for “£1.50” (Tesco, 2023). Tesco utilises various digital marketing techniques in addition to its traditional strategies to attract potential buyers. In 2020, Tesco invested approximately £81.15 million in the UK for advertising its products and services (Kar et al. 2021). Tesco has created a large and diverse workforce to support its operations in foreign and native markets. It has incorporated adequate HRM practices to create an inclusive environment for its workforce.

Elaboration of corporate strategy for international expansion

International expansion is essential for all businesses as it increases reach to potential consumers. The UK grocery market has been saturated due to the presence of multiple brands such as Asda, and Lidl. Tesco has concentrated on expanding its business to a foreign country to maximise its profit and enhance its brand presence in the global market. Tesco first expanded its business into Ireland in the 1980s and currently operating by establishing 164 stores in cities with nearly 13,000 employees (Tesco, 2023). Tesco has acquired around 500 local suppliers through which they are providing fresh meat and fruit sourced from Ireland. Later, the enterprise further expanded its business to France and Hungary through the acquisition of “S-Market”.

Tesco started its expansion in Europe with Poland in 1995 by opening nearly 450 stores and had plans for reaching 500 stores by 2013. However, product sales in Poland have decreased significantly due to the popularity of “discount stores” and smaller supermarkets. Hence, Tesco has been downsizing its operation in the country by laying off employees and reducing costs and it currently has 322 stores in Poland (Krummel, 2022). Tesco has also failed to penetrate the Japanese market through the acquisition of “C Two-Network” for £173 million. The main reason behind failure in Japan is the increased cost of operating stores and the demand for consumers (Merrill and Merrill, 2019). Later, international expansion in the U.S. also emerged as a significant challenge for the enterprise. Tesco has expanded its business in the U.S. by establishing nearly 60 new “Fresh & Easy” stores in “California”.

However, the stores have been criticised for employing only “part-time” workers leading to a $200 million loss. Additionally, Tesco has been forced to close stores in Nevada, California and Arizona due to the weak economy (Ahmed and Moosafintavida, 2020). On the other hand, Tesco has been initially successful in penetrating the market of “Thailand” and “Malaysia”. Later, the enterprise sold its business to the “CP Group” of Thailand due to the financial difficulties faced in the U.K. market.

Price policy and cost control

Tesco has integrated the cost-leadership strategy to minimise the cost of operations which assists them in reducing the price of products and services. The firm aims to avail affordable products to consumers without compromising their quality (Singh et al. 2021). Tesco can offer deals and discounts on food and “non-food” products by acquiring local suppliers. The enterprise establishes a strong relationship with the local suppliers to reduce the cost of transportation. The pricing of the product is based on the average income of the demographics which has made the firm popular among various segments of buyers. Tesco has also integrated a “Cost-plus pricing” strategy to add a fixed percentage on the offered products (Qi et al. 2020). Through this strategy, Tesco has been able to minimise its efforts in market research. The “cost-plus pricing” also ensures full coverage regarding the production value of the goods and maintains a steady return on the products.

Additionally, it has helped Tesco in pricing its products according to the market prices which has helped in availing affordable products to the consumers. Tesco controls the operational cost by employing a lower number of employees in the stores. The enterprise also provides its brand products such as “Tesco cooking oil”, “Tesco value toilet rolls” and “mineral water” which are available at lower prices. Influencing the sale of its brand products, the firm generates higher profits. The use of “energy-efficient bulbs” has also assisted the enterprise in decreasing its operational expenses (Petljak, 2021). Moreover, Tesco offers deals and discounts on products which are about to expire. It helps the enterprise in saving losses on products and gains consumer attention due to low prices.

Assessment of the supply chain of Tesco

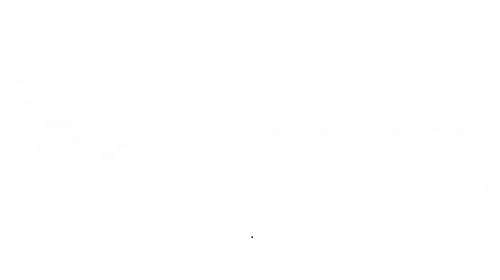

The supply chain is an integral part of the retail business as it acquires the raw materials and goods which are then sold to the end users. The “Supply Chain Management or SCM” of Tesco highlights a strategy of “Vertical integration” in which the firm controls various stages of the supply chain. Tesco has incorporated this strategy by establishing a supplier network, and “stockless distribution depots” by taking responsibility for various activities of the SC (Domański and Łabenda, 2020). Tesco has also implemented the “Just-in-time” principle for its SC and inventory management to reduce cost and food waste. It has helped the firm to assess the need of the consumers and create a forecast for upcoming demands. It has helped the enterprise in improving the efficacy of the operations related to the SCM.

Figure 1: Vertical integration

(Source: Domański and Łabenda, 2020)

The integration of “Machine Learning or ML” has assisted Tesco in automating its inventory management which has provided adequate predictive analysis to highlight the buying trends of the consumers. Automating the procurement procedures has aided the company in improving supplier communication ad streamlining its operations (Paavola and Cuthbertson, 2022). Tesco has reorganised its SC as it has expanded its business in the international market and faced changing demands. The enterprise has implemented a “steering wheel” approach to monitor the performances of its SCs to maintain high quality and improve coordination. On the other hand, Tesco offers nearly 20,000 merchandise which includes electronics, and apparel.

The firm has acquired diversified suppliers for the massive range of products to ensure “on-shelf” availability for the items. The operational structure is incorporated with innovative technology to support a steady flow of information in all stages which enhances the operational efficacy (Taqatqa, 2021). The firm also has depots for fresh fruits which has a capacity of 80 million crates in each site along with the controlled temperature.

Health, safety and environmentally friendly operation Strategy

Tesco has prioritised the safety of the employees through providing services such as “Occupational Health”, “Employee Assistance Programme” and mini check-ups. It helps the firm in maintaining a positive environment in the workplace. Additionally, it maintains the quality of its offered products and services to ensure the safety of the consumers as well (Chkanikova and Sroufe, 2021). The employees are also provided with online learning programmes to ensure comprehensive knowledge regarding various processes which reduces the risk of accidents in the workplace (Nyame-Asiamah and Ghulam 2020). Moreover, corporate policies include various regulations to reduce safety risks which are controlled by professionals.

Figure 2: Tesco’s approach to restricting harmful chemicals

(Source: Tesco, 2023)

Recommendations

Partnership

The international expansion of Tesco has highlighted a significant struggle to recognise the foreign market demand and to sustain the higher operational costs. The enterprise needs to improve its corporate strategy for global expansion. Partnering with local brands is a suitable approach for Tesco in entering into a new retail market. A partnership can provide the enterprise with adequate support to maintain a sustainable operation cost during the initial period. Local retail firms are also equipped with better knowledge regarding the local demographics and their preferences (Krummel, 2022). It can help Tesco in providing relevant products and adjusting its pricing strategy to increase product value to potential consumers. Additionally, the partnership can reduce the financial risk of expansion as Tesco can acquire substantial funding from the other party to reduce its investment in the physical stores.

Conclusion

The study has shed light on the operational process of Tesco through a detailed analysis of its operations, international expansion and SCM. Tesco has greatly expanded the variety of its items by offering consumers books, toys, gadgets, apparel, and a variety of other services. The company also has subsidiaries for banking, telecom, and internet service. Tesco has rebranded itself as a “low-cost” supermarket, which has helped the corporation is becoming more well-liked by customers. The international expansion of Tesco has displayed a negative outcome. Tesco has been forced to reduce its operations in Poland, Malaysia, Japan and the U.S. due to unprecedented financial situations. Due to financial challenges in the U.K. market, the company sold its operations to the Thai “CP Group.” The enterprise attempts to provide people with high-quality products at reasonable prices. Tesco has acquired local suppliers, which allows it to provide specials and discounts on both food and “non-food” items. Tesco can integrate a new approach to entering a new retail market by creating partnerships with local brands to reduce its chances of failure and financial loss.

References

Ahmed, J.M. and Moosafintavida, S., 2020. Why nabors industries (NBR) Acquired Tesco Corporation (TESO) in an all-stock transaction: A case study. International Journal of Applied Science and Engineering, 8(2), pp.133-140.

Chkanikova, O. and Sroufe, R., 2021. Third-party sustainability certifications in food retailing: Certification design from a sustainable supply chain management perspective. Journal of Cleaner Production, 282, p.124344.

Dhyana, B. and Gupta, O., 2022. Evaluating the management model of information systems and its applicability in enhancing business operations in Tesco. Central European Management Journal, 30(3), pp.353-357.

Domański, R. and Łabenda, M., 2020. Omnichannel of private label grocery products in Tesco and Carrefour retail chains on the Polish market. Ekonomski Vjesnik, 33(1), pp.191-202.

Hashim, M., Nazam, M., Abrar, M., Hussain, Z., Nazim, M. and Shabbir, R., 2021. Unlocking the sustainable production indicators: a novel tesco based fuzzy AHP approach. Cogent Business & Management, 8(1), p.1870807.

Kar, S.K., Bansal, R. and Mishra, S., 2021. Tesco: Entry and Expansion Strategy in India. Emerging Economies Cases Journal, 3(2), pp.65-76.

Krummel, D., 2022. Expansion in the Retail Sector—Market Entry Strategies in Consideration of Formal and Informal Institutions: A Tesco Case Study. Open Access Library Journal, 9(2), pp.1-19.

Merrill, G.J. and Merrill, G.J., 2019. How Sinful Is Your Shopping Basket? The Reporting of Tesco in 2006, 2007 and 2008. The Political Content of British Economic, Business and Financial Journalism: A Deficit of Perspectives, pp.143-181.

Nyame-Asiamah, F. and Ghulam, S., 2020. The relationship between CSR activity and sales growth in the UK retailing sector. Social Responsibility Journal, 16(3), pp.387-401.

Paavola, L. and Cuthbertson, R., 2022. Redefining capabilities as drivers of adaptation, incremental change, and transformation: Recognizing the importance of strategic and operational intent on performance. Journal of Management & Organization, 28(3), pp.522-539.

Petljak, K., 2021. IN-STORE ENVIRONMENTALLY RESPONSIBLE ACTIVITIES OF FOOD RETAILERS. Economic and Social Development: Book of Proceedings, pp.324-331.

Qi, X., Chan, J.H., Hu, J. and Li, Y., 2020. Motivations for selecting cross-border e-commerce as a foreign market entry mode. Industrial Marketing Management, 89, pp.50-60.

Rosnizam, M.R.A.B., Kee, D.M.H., Akhir, M.E.H.B.M., Shahqira, M., Yusoff, M.A.H.B.M., Budiman, R.S. and Alajmi, A.M., 2020. Market opportunities and challenges: A case study of Tesco. Journal of the Community Development in Asia (JCDA), 3(2), pp.18-27.

Singh, P., Ranjith, P.V., Fathihah, N., Kee, D.M.H., Nuralina, N., Nurdiyanah, N. and Nursyahirah, N., 2021. Service Quality Dimension and Customers’ Satisfaction: An Empirical Study of Tesco Hypermarket in Malaysia. International Journal of Applied Business and International Management (IJABIM), 6(3), pp.102-114.

Taqatqa, A., 2021. 5 Tesco. Business Management Case Studies: Pran-RFL, Netflix, Mc Donalds, Google, Tesco, Apple, COCA COLA, PSA Group, Mercedes, Tesla, Toyota, Beximco, KFC, LBC Lao Brewery Company, p.97.

Tesco, 2023. Tesco. [Online]. Available at: https://www.tesco.com/ [Accessed on 05-04-2023]