CASE STUDY DEVELOPMENT OF TOYOTA AUSTRALIA

Executive summary

The Australian division of a Japanese automaker, Toyota Australia, was founded in 1963. For 16 years in a row, the company has held the title of Australia’s top-selling automotive manufacturer. Following the COVID-19 epidemic, the automotive industry had a substantial transformation because of the economic downturn, shifting consumer tastes, rising gas prices, and supply chain disruptions. Due to the quick development of technology, EVS, hybrid, and autonomous vehicles have also become a major trend in the international automotive industries. In order to analyse some recommendations, this paper analyses Toyota Australia’s strategic plan by looking at its competitors, industry difficulties, and corporate strategy.

1.0 Introduction

Toyota Australia is a Japanese automobile manufacturer’s Australian subsidiary, established in 1963. The organisation has acquired the title of the top-selling automotive manufacturer in Australia for 16 years consecutively in 2019. The firm is currently researching alternative fuels, connected vehicles, autonomous driving, and many more to contribute toward a “zero-carbon society”. This report analyses the strategic plan of Toyota Australia by examining its competitors, industry challenges, and company strategy to analyse a few recommendations.

2.0. Aim and Objectives of the Case Study

The aim of the case study report is to analyse the strategic plan of Toyota Australia by providing a discussion of its industry, evolving challenges, competitors, and strategies used by the firm.

Objectives

- To examine the evolving challenges of the automobile industry in Australia

- To evaluate the key competitors of Toyota Australia

- To discuss the strategy followed by Toyota Australia

- To highlight appropriate recommendations for the organisation

3.0 Introduction to the Company

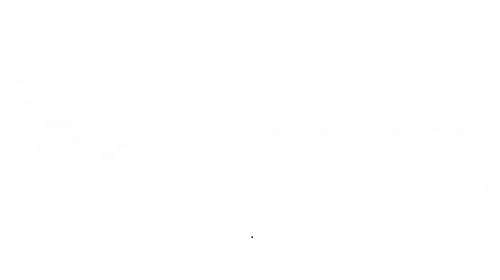

Toyota has been established as one of the reputable and popular automotive brands in Australia, which has been operating in the country for almost 60 years. “Toyota Motor Corporation Australia or TMCA” is a fully owned subsidiary of “Toyota Motor Corporation (TMC)” (Toyota Australia, 2023). TMCA has established its headquarters in Port Melbourne, Victoria along with four regional offices across the country. However, the organisation do not have a regional office in “Western Australia”, where a third-party seller is used to distribute Toyota-branded vehicles and TMCA distributes Lexus-branded vehicles. Due to the impact of COVID-19, the sale of vehicles has slowed down significantly; however, the annual revenue is projected to reach around USD 5 billion at the end of 2023, with a CAGR of 4.49% until 2027. It highlights a growth in vehicle sales, which is expected to reach approximately 196.2 thousand vehicles in 2027.

Figure 1: Vehicle sale of TMCA in Australia

(Source: Statista, 2023)

The vision of the firm is “creating innovative mobility solutions for all Australians”. In 2019, the organisation was able to sell around 223,096 units with an 82.7 score in Net profit. TMCA currently employs 1,452 employees along with 281 dealerships and invested $1.2 billion in the supplier network. Additionally, TCMA has integrated three SDGs; “SDG 3: Good Health and Wellbeing”, “SDG 13: Climate Action”, and “SDG 11: Sustainable Cities and Communities” (James, 2021). The organisation has made approximately an investment of $2.5 million in the community and planted over 1 million native trees. The “Toyota Production System Support Centre (TSSC)” has been supporting 43 small businesses and non-profit organisations (Toyota Australia, 2023). Furthermore, the firm has shifted toward more sustainable electric and hybrid vehicles leading to the sale of around 100,000 hybrid cars.

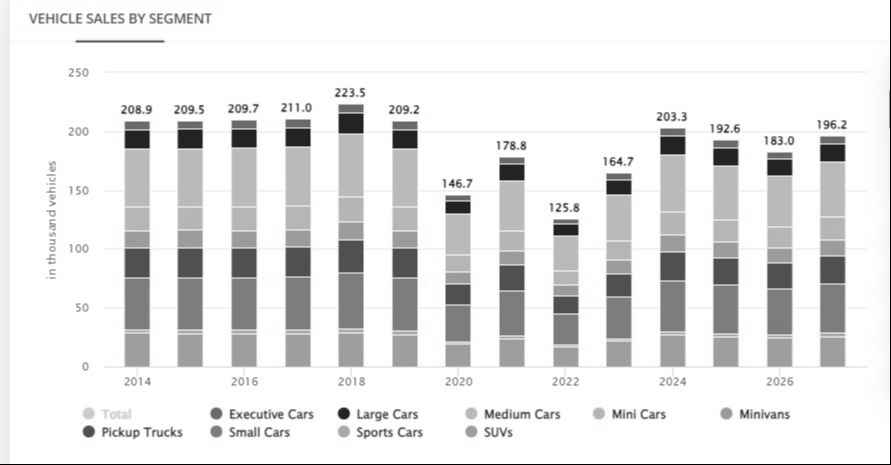

Figure 2: Sale of Toyota Vehicles in Australia

(Source: Statista, 2023)

In 2017, TMCA was able to sell nearly 216.57 thousand vehicles in the country, which has reduced significantly in 2018 with around sale of 182.8 thousand vehicles. In 2019, the number of sold vehicles diminished to 171.5 due to the emerging COVID-19 pandemic and the changing requirements of consumers in the automotive market.

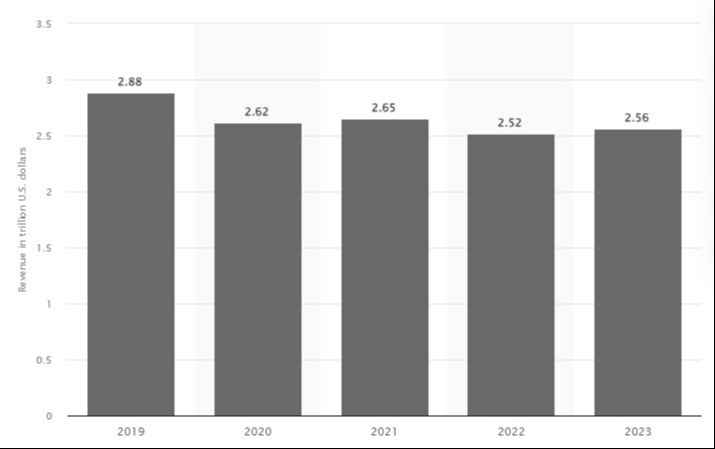

4.0 Discussion on the Industry

The global automobile industry has faced significant changes after the COVID-19 pandemic in terms of decreased demand and changing consumer preferences. In 2019, the automobile industry had a revenue of approximately USD 2.88 trillion, which saw a significant decrease to nearly USD 2.62 trillion in 2020. In the aftermath of the pandemic, the industry has seemed to recover gradually with a revenue of USD 2.65 trillion in 2021 and USD 2.52 trillion in 2022 (Statista, 2023). At the end of 2023, the automotive industry is projected to acquire around USD 2.56 trillion, which highlights a gradual increase in market demand. Additionally, the automotive industry is observing a significant shift toward electric vehicles as around 26% of the vehicle sales are projected to be electric cars by 2030. Approximately 58 million self-driving cars are projected to be new additions to the world’s feet in 2030 as well.

Figure 3: Revenue of the global automotive sector

(Source: Statista, 2023)

The sales of EVs have surpassed the level of 2019 and have been increasing 40% annually from 2020. It projects that around 10 million EVs are now in use, with Europe and China showing high demand for electric cars. Europe has been identified as one of the largest markets in the world for plug-in EVs. The popularity of EVs has stemmed from countries focusing on reducing pollution and governments taking active initiative in growing the popularity of EVs among common people by providing certain benefits to EV owners. Alongside EVs, autonomous vehicles have been also in trend in the global market, which acquired a market value of USD 30.2 million in 2020. The market of autonomous vehicles has been projected to grow at a CAGR of 13.3% to reach around USD 62.4 million in 2030 (Statista, 2023).

5.0 Evolving Dynamics (challenges) of the industry

The pandemic period has created significant challenges for the global automotive industry due to social distancing norms and lockdown protocols. Governments of various countries have enforced health and safety regulations, which has resulted in the shutdown of the manufacturing processes. In the aftermath of the pandemic period, the automotive industry is still struggling to get back to the pre-pandemic production level. The manufacturing shutdown of the automotive sector has accentuated the existing challenges of lack of resources and excess production (Irving et al. 2022). Additionally, less vehicle sales is another challenge for the global automotive sector due to economic recessions. Consumers around the world were more concerned with sourcing daily essentials rather than indulging in vehicle purchases.

There have been significant changes in consumer behaviour especially in the younger generation as they have access to online material and platforms researching various brands and their offered products. It has increased the competition in the sector as automotive companies are providing a combination of in-person and online interactions. Consumers are now more inclined toward vehicles, which they can customise according to their needs along with people interested in mainstream models. Moreover, automotive manufacturing companies have faced significant layoffs due to the lockdown period (Conley, 2022). It created a significant gap in expertise in the automotive sector, as it is unable to acquire an effective workforce or reach the pre-pandemic level. Furthermore, the rise in oil prices has also affected the sales of the automotive industry. The “Ukraine-Russia conflict” has induced the price of petrol, which has in turn increased the cost of daily commodities affecting the purchasing power of the consumers.

The rising cost of petrol has affected consumer behaviour in the automotive industry as a significant portion of car owners are inclining toward EVs and hybrid cars. On the other hand, people are less interested in buying cars as it would increase their expenses due to the increasing cost of petrol. In addition, supply chain disruption during COVID-19 has also created a significant challenge for the automotive industry as it has increased the cost of “Lithium-ion batteries”, which are used in EVs.

6.0 Competitors

Toyota Australia faces a significant rivalry in the automotive sector due to the presence of popular brands like Mazda, MG, Tesla, Kia, and Mitsubishi.

Internal resources

Internal resources of TMCA highlight the effective workforce and the HRM processes, which have helped the firm, retain its top position in Australia. The firm acquires a diverse workforce to help the native communities along with fostering a sense of inclusive culture in the workplace (Wang, 2021). As TMCA is a subsidiary of Toyota, it has access to greater capital than its competitors do.

Corporate governance

TMCA has been following the “Toyoda Principles” of the founder “Sakichi Toyoda”, which highlights the importance of cooperation among people from different countries (Nomura, 2021). The principle highlights that the organisation respects the language and the law of every country and facilitates fair business activities. The contribution toward native communities, people, and small organisations highlights the spirit of CSR (Liedtke, 2019). On the other hand, TMCA has been able to foster a positive work culture to facilitate innovation, creativity, teamwork, and mutual benefits. On the other hand, Mazda follows a hierarchical corporate structure, which depicts the inclusion of shareholders and owners in decision making excluding the employees. Similarly, Tesla has a hierarchical corporate structure, which stifles the innovation and creative ideas of the employees.

Product offering

TMCA has been able to double its product sales due to its HiLux, Landcruiser, RAV4, and Corolla models. A total of 1,081,429 vehicles have been sold in 2022 of which around 231,050 vehicle sales were from TMCA, which denotes a 3.3% increase from 2021. Mazda has captured second place with 135,000 sales, which is around 5.3% decrease from 95,718 sales in 2021. Toyota’s RAV4 has been the top-selling SUV with 34,845 sales worldwide followed by Mazda CX-5 with 27,062 sales (Soliman, 2020). In terms of popular vehicles, the Toyota Landcruiser has taken the third spot with 24,452 sales. In the fourth spot, MG ZS has taken place with 22,466 sales combining its “electric ZS EV” and petrol variants.

Marketing campaigns

TMCA has been utilising online marketing tactics, with the help of social media, official websites and mobile apps. Social media and website marketing have assisted the firm in enhancing its presence in the automotive market. Similarly, digital marketing has been common among competitors such as Tesla, Mazda, and Kia. However, TMCA has developed “myToyota Connect”, which connects with the brand vehicles and provides car owners with information regarding odometer, fuel levels, location, and remote functionality (Ohno, 2019). The app provides consumers with comprehensive information regarding various Toyota models, allowing them to gain in-depth insight. Developing the mobile app to connect with consumers has enabled the firm to increase consumer awareness about its products and assisted in product sales.

7.0 Strategy Followed by the Company

Differentiation strategy

TCMA has integrated differentiation as their competitive strategy, which highlights the importance of uniqueness to attain a competitive edge over its rivals. The strength of this strategy is the focus on product quality, which has made TCMA one of the most reliable brands in Australia. It has assisted the firm in gaining a positive brand reputation among consumers, which is associated with the trustworthiness of its products attracting a loyal consumer base (Head et al. 2023). Additionally, the firm has invested heavily in the R&D department to integrate new technologies in their vehicles. TCMA has introduced electric and hybrid cars according to the trends and requirements of the global market. Moreover, the differentiation strategy has assisted the firm in diversifying its product portfolios to attract low-end and high-end consumers with its products.

On the other hand, the differentiation strategy requires significant financial investment and maintaining high quality. As a result, the production cost of TCMA is quite high to provide the consumers with quality and reliable products, which affects profitability and pricing. In addition, majority of the automotive firms are using differential as their competitive strategy to stand out in the intensely competitive market of the automobile industry (Bhattacheryay, 2023). As most of the automotive companies such as Tesla, Kia, Mitsubishi, and Mg incorporate product differentiation, it can be challenging for TMCA to maintain its unique position in the market. Moreover, the changing preferences of the consumers can negatively affect the differentiation strategy, as TCMA need to analyse the requirements of the consumers carefully before differentiating its products.

Low-cost leadership strategy

TCMA follows a low-cost leadership strategy to leverage its manufacturing capabilities and huge production volume to attain higher cost efficiency. Through the integration of the “Toyota Production System (TPS)”, the organisation has been able to minimise wastage to optimise its production process, which has assisted the firm in offering consumers competitive pricing on its vehicles (Mpehle et al. 2020). On the other hand, low-cost leadership often leads to concerns over the quality of the products and restricts the ability to integrate advanced technology into its products due to budget limitations. Additionally, low-cost leadership prioritises reducing manufacturing costs, which can conflict with the sustainability and environment-friendly goals of the firm.

8.0 Conclusion

The study has shed light on the strategic plan of Toyota Australia by analysing its background and industry challenges. The automotive industry has gone through a significant shift after the COVID-19 pandemic due to the economic recession, changing consumer preferences, price hikes of petrol, and supply chain disruptions. Additionally, EVS, hybrid, and autonomous vehicles have emerged as a growing trend in the global automotive sectors due to the rapid advancement in technology. TCMA has been using differentiation and low-cost leadership to obtain a competitive advantage in the market.

9.0 Recommendations

TCMA need to invest heavily in hybrid and electric vehicles as it aligns with the changing market trends and growing concerns over climate change. It can help the organisation establish a positive image among the consumers towards their dedication to achieving SGDs. Additionally, the organisation can implement big data analytics for its supply chain to increase visibility on its resourcing, storage and inventory management processes (Aunyawong et al. 2020). It can help TMCA withstand challenging situations similar to the COVID-19 pandemic by leveraging predictive analysis.

References

Aunyawong, W., Wararatchai, P., & Hotrawaisaya, C. (2020). The influence of supply chain integration on supply chain performance of auto-parts manufacturers in Thailand: a mediation approach. International Journal of Supply Chain Management, 9(3), 578-590. Retrieved on 8th September, 2023, from: https://elcls.ssru.ac.th/preecha_wa/pluginfile.php/36/block_html/content/%E0%B8%99%E0%B8%B2%E0%B8%A2%E0%B8%A7%E0%B8%B4%E0%B8%A8%E0%B8%A7%E0%B8%B0%20%E0%B8%AD%E0%B8%B8%E0%B8%99%E0%B8%A2%E0%B8%B0%E0%B8%A7%E0%B8%87%E0%B8%A9%E0%B9%8C_The%20Influence%20of%20Supply%20Chain%20Integration%20on%20Supply%20Chain%20Perf.pdf

Bhattacheryay, S. (2023). Multinational working capital management a study on Toyota Motor Corporation. International Journal of Finance & Economics, 28(1), 236-256. Retrieved on 8th September, 2023, from: https://onlinelibrary.wiley.com/doi/abs/10.1002/ijfe.2418

Conley, T. (2022). The decline and fall of the Australian automotive industry. The Economic and Labour Relations Review, 33(2), 415-433. Retrieved on 8th September, 2023, from: https://www.cambridge.org/core/journals/the-economic-and-labour-relations-review/article/decline-and-fall-of-the-australian-automotive-industry/47076B1858381890D0FE596DB389216F

Head, K., Ondracek, J., Saeed, M., Peterson, K., & Bertsch, A. (2023). Toyota Motor Corporation: Managing Corporate Resources Through Strategic Perspectives. Retrieved on 8th September, 2023, from: https://www.indianjournals.com/ijor.aspx?target=ijor:sijp&volume=10&issue=1&article=001

Irving, J., Beer, A., Weller, S., & Barnes, T. (2022). Plant closures in Australia’s automotive industry: Continuity and change. Regional Studies, Regional Science, 9(1), 5-22. Retrieved on 8th September, 2023, from: https://www.tandfonline.com/doi/abs/10.1080/21681376.2021.2016071

James, R. (2021). The Toyota Way or the unions’ way?: Examining the nexus between lean and unions in Toyota Australia. The International Journal of Human Resource Management, 32(6), 1273-1311. Retrieved on 8th September, 2023, from: https://www.tandfonline.com/doi/abs/10.1080/09585192.2018.1513413

Liedtke, C. A. (2019). Advances in Strategic Planning. In Presented at the 11th Annual Advanced Strategic Improvement Practices Conference (Vol. 10, p. 29). Retrieved on 8th September, 2023, from: https://strategicimprovementsystems.com/wp-content/uploads/2020/01/SIS_LIEDTKE_ADVANCES_STRATEGIC_PLANNINIG_PUBLIC.pdf

Mpehle, Z., Farhansyah, A., Haeruddin, M. I. W., & Haeruddin, M. (2020). One Way or Another: A Report of Toyota’s Company Social Performance. International Journal of Educational Administration, Management, and Leadership, 2(2). Retrieved on 8th September, 2023, from: http://eprints.unm.ac.id/27823/

Nomura, S. (2021). The Toyota Way of Dantotsu Radical Quality Improvement. CRC Press. Retrieved on 8th September, 2023, from: https://books.google.com/books?hl=en&lr=&id=tKgmEAAAQBAJ&oi=fnd&pg=PP1&dq=toyota+australia&ots=aBK-0rRzK6&sig=pfzhMZPoWurFvL0jnQFEsZAf90s

Ohno, T. (2019). Toyota production system: beyond large-scale production. Productivity press. Retrieved on 8th September, 2023, from: https://www.taylorfrancis.com/books/mono/10.4324/9780429273018/toyota-production-system-taiichi-ohno

Soliman, M. H. A. (2020). The toyota way to effective strategy deployment: how organizations can focus energy on key priorities through Hoshin Kanri to achieve the business goals. Journal of Operations and Strategic Planning, 3(2), 132-158. Retrieved on 8th September, 2023, from: https://journals.sagepub.com/doi/abs/10.1177/2516600X20946542

Statista, (2023). Global car manufacturing industry revenue between 2019 and 2022. [Online]. Retrieved on 8th September, 2023, from: https://www.statista.com/statistics/574151/global-automotive-industry-revenue/

Statista, (2023). Number of Toyota vehicles sold in Australia from 2013 to 2019. [Online]. Retrieved on 8th September, 2023, from: https://www.statista.com/statistics/632643/australia-toyota-vehicle-sales/#:~:text=As%20of%20October%202019%2C%20around,the%20nation%20from%20October%202018.

Statista, (2023). Toyota (Passenger Cars) – Australia. [Online]. Retrieved on 8th September, 2023, from: https://www.statista.com/outlook/mmo/passenger-cars/toyota/australia

Toyota Australia, (2023). Toyota Australia: New Cars, SUVs, 4WDs, Utes, Hybrids. [Online]. Retrieved on 8th September, 2023, from: https://www.toyota.com.au/

Wang, Z. (2021). Exploring the potential of lean philosophy to spread the value of sustainability in the Japanese automobile industry: the case of Toyota Motor Corporation. Управління розвитком складних систем, (45), 176-181. Retrieved on 8th September, 2023, from: http://mdcs.knuba.edu.ua/article/view/238895